REGISTRATION GUIDELINE

| Physical participation only. Please register in advance to reserve your seat.

The event is held under the Chatham House Rule. Images from the event may be used for AmCham Vietnam – HCMC’s post-event information, marketing and promotional purposes. The personal information provided to us will only be used for event registration and administration. By registering for this event, you agree and consent to the above. |

Event Description

As Vietnam begins implementing the Global Minimum Tax (GMT) framework, businesses are facing a new era of international tax compliance and strategic adjustment. This session will provide an in-depth look at the core principles of the OECD’s Pillar Two rules, Vietnam’s approach to adoption, and the key implications for multinational enterprises operating in the country.

In this seminar, our expert from leading tax advisory firm will discuss the practical challenges encountered during the first year of implementation — from data readiness, calculation complexities, and intercompany adjustments to potential impacts on investment incentives and enterprise competitiveness.

Participants will gain valuable insights into:

- Overview of the global minimum tax (GMT)

- Scope of GloBE rules

- Compliance requirements

- Safe harbour

- Financial accounting standards and currency

- Top-up tax calculation

- Necessary preparation

|

| 8:30 AM | Registration & Refreshment |

| 8:55 AM | Opening remarks by AmCham |

| 9:00 AM | Presentation |

| 10:30 AM | Q&A session |

| 11:00 AM | Event ends |

| AmCham Members: VND 650,000 | Non-members: VND 850,000 |

| Reservations/cancellations must be received by 24 hours before the event, and must be made on-line or by email. We are unable to accept reservations/cancellations by telephone. |

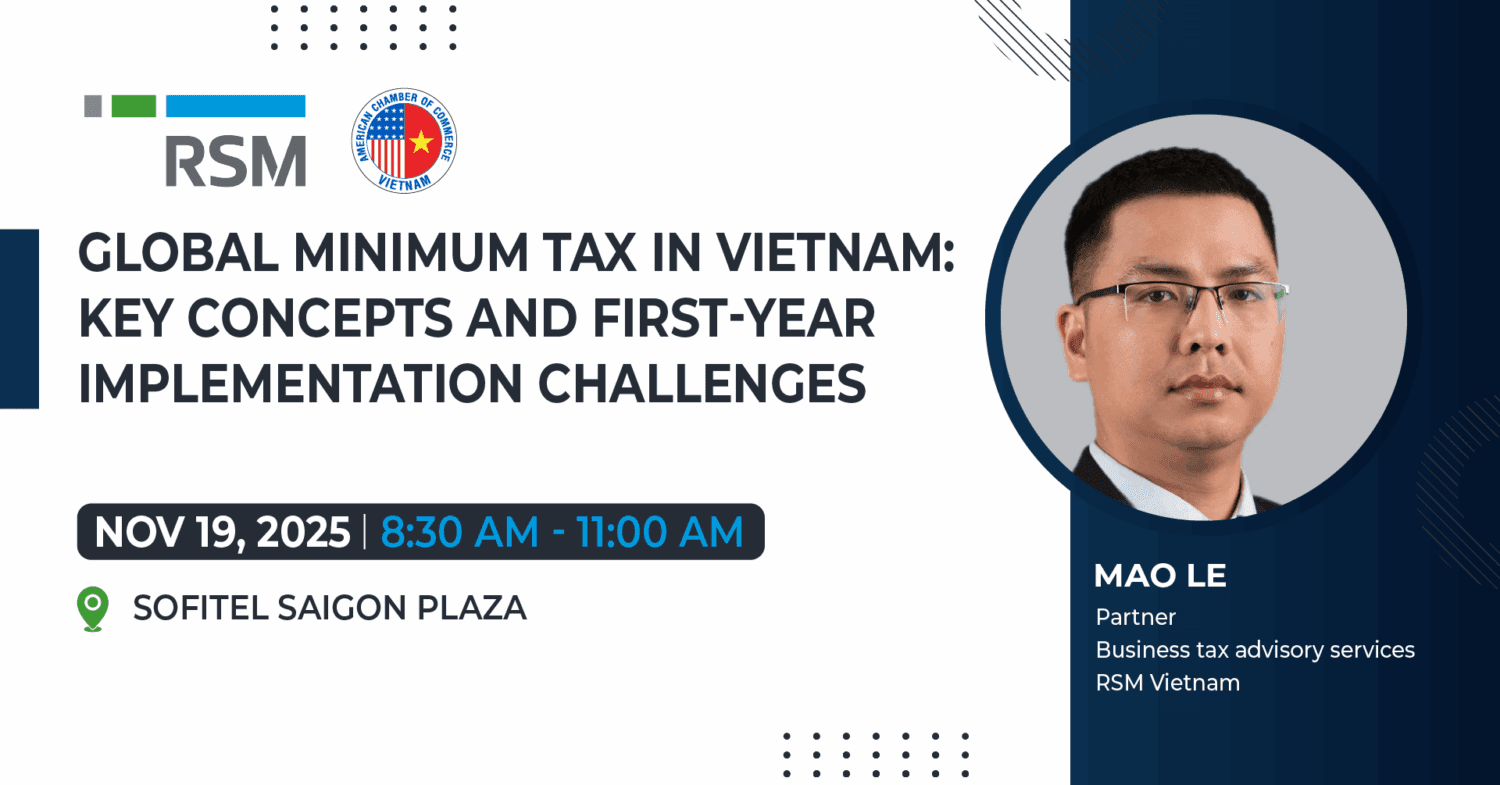

Mao Le Mao Le

Partner, Business tax advisory services RSM Vietnam Mao has over 15 years of experience in legal and tax consulting in Vietnam. Prior to rejoining RSM Vietnam, he has worked for one of the Big Four in Vietnam. Mao has involved in a number of comprehensive tax advisory engagements and tax restructuring projects for Vietnamese and multinational corporations in a wide variety of industries, including energy, gas & oil, manufacturing, FMCG, etc. Mao has actively participated as a key member in providing various taxation services including: due diligence, tax planning; corporate tax compliance review; tax audit assistance and compliance. He also hands-on in dealing with competent authorities in Vietnam. He has represented various clients in dealing with competent authorities on taxation issues, both at local and national levels. |