REGISTRATION GUIDELINE

| Physical participation only. Please register in advance to reserve your seat.

The event is held under the Chatham House Rule. Images from the event may be used for AmCham Vietnam HCMC & Danang HCMC & Danang’s post-event information, marketing and promotional purposes. The personal information provided to us will only be used for event registration and administration. By registering for this event, you agree and consent to the above. |

Event Description

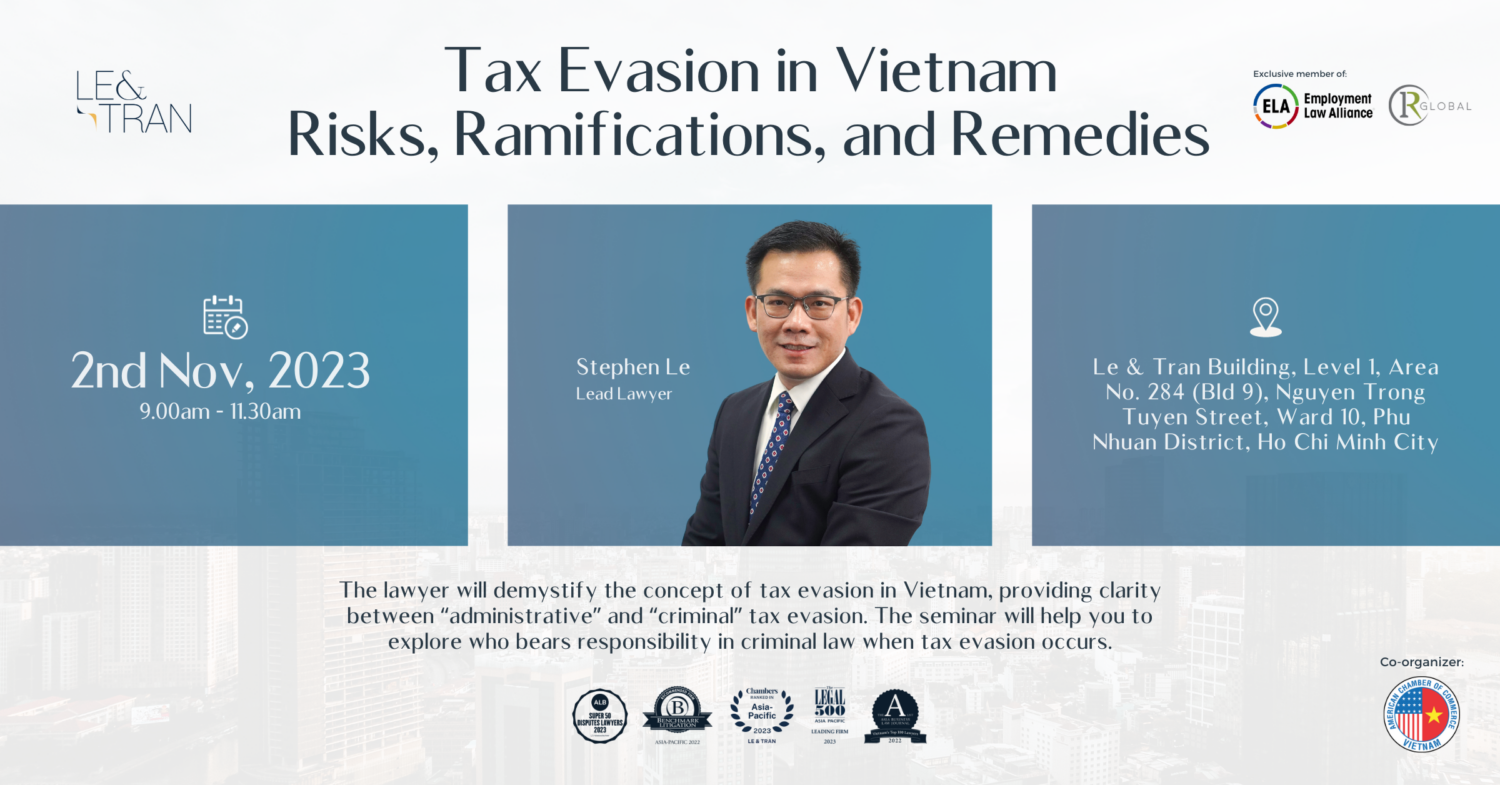

Join us for an exciting discussion on “Tax Evasion in Vietnam: Risks, Ramifications, and Remedies” to gain valuable insights into the intricate landscape of tax compliance and legal accountability. Our lead lawyer, Stephen Le, will demystify the concept of tax evasion in Vietnam, providing clarity between “administrative” and “criminal” tax evasion. The seminar will also help you to explore who bears responsibility in criminal law when tax evasion occurs. Practical strategies for businesses to minimize risks will also be discussed, ensuring that you can navigate the complexities of tax evasion and protect your business interests. Don’t miss the opportunity to engage with Stephen in an informative Q&A session—this event is a must-attend to safeguard your interests in Vietnam’s tax environment!

Le Hoang Chuong (Stephen) Chairman – Lead Litigator, Le & Tran |

|

| 8:30 AM | Registration & Refreshment |

| 9:00 AM | Welcome remarks |

| 9:05 AM | Presentation, followed by Q&A |

| 11:30 AM | Event ends |

| AmCham Members: VND 200,000 | Non-members: VND 350,000 |

| Reservations/cancellations must be received by 24 hours before the event, and must be made on-line or by email. We are unable to accept reservations/cancellations by telephone. |